The BRRRR Strategy: A Powerful Tool for Real Estate Investors

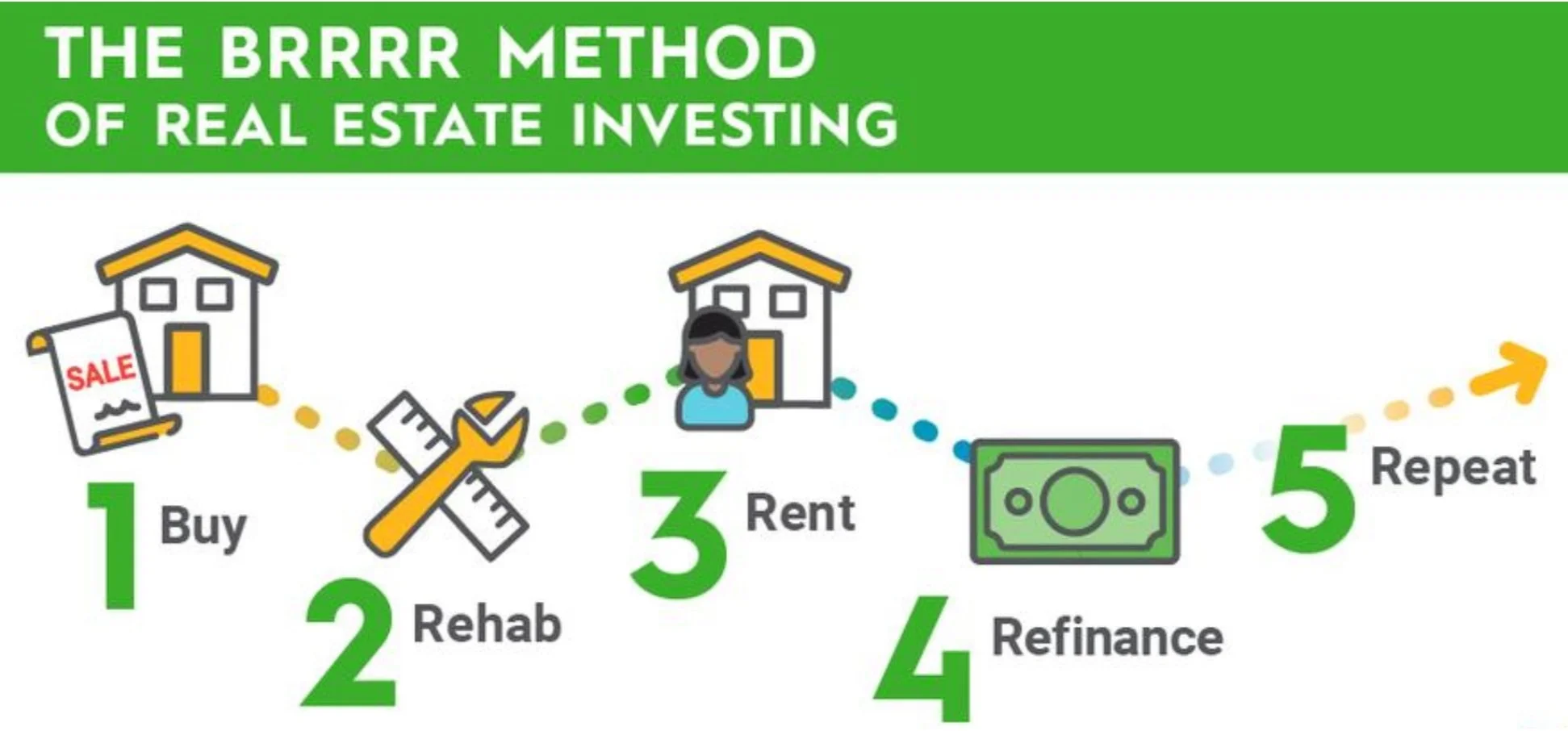

If you're a real estate investor, you've probably heard of the BRRRR strategy. It's a popular method for acquiring properties, rehabbing them, and then refinancing them to pull out your initial investment. The name "BRRRR" stands for Buy, Rehab, Rent, Refinance, Repeat, and it's a powerful tool for building wealth through real estate.

The BRRRR strategy involves buying a property that needs some work, renovating it to increase its value, renting it out to generate income, and then refinancing the property to pull out your initial investment. The goal is to use the cash flow from the rental income to pay for the renovations and the mortgage, while also building equity in the property. Once the property is fully renovated and rented, you can refinance it to take out a new mortgage with a lower interest rate and better terms, which allows you to pull out some of the equity you've built up and use it to invest in more properties.

One key rule that many real estate investors follow when using the BRRRR strategy is the 70% rule. The 70% rule states that you should aim to purchase the property for no more than 70% of its after-repair value (ARV), minus the cost of renovations. This rule helps ensure that you're buying the property at a discounted price, leaving room for profit and minimizing the risk of overpaying for a property.

The 70% rule states that an investor should pay no more than 70% of the After Repair Value (ARV) of a property, minus the cost of the renovations. This means that if a property's ARV is $200,000, and the cost of renovations is estimated to be $30,000, the most an investor should pay for the property is $110,000 (70% of $200,000 minus $30,000).

The 70% rule is important because it ensures that an investor is buying the property at a price that allows them to make a profit. By sticking to this rule, investors can avoid overpaying for a property and minimize their risk.

When using the BRRRR strategy, the 70% rule can help investors determine whether a property is a good investment. If the property's purchase price, renovation costs, and holding costs exceed 70% of the ARV, it may not be worth investing in. Conversely, if the total cost is significantly less than 70% of the ARV, it may be a great investment opportunity.

Here's a step-by-step breakdown of how the BRRRR strategy works:

Buy: Find a property that is undervalued or in need of some work. This could be a foreclosure, a distressed property, or a fixer-upper that is priced below market value.

Rehab: Renovate the property to increase its value. This could include repairing structural issues, updating the kitchen and bathrooms, adding a fresh coat of paint, or landscaping the yard.

Rent: Once the property is renovated, rent it out to generate income. This will help cover the mortgage, taxes, insurance, and other expenses associated with owning the property.

Refinance: After the property has been rented out for a period of time, refinance the mortgage to pull out some of the equity you've built up. This will allow you to use the funds to invest in more properties or pay off other debts.

Repeat: Use the cash flow from the rental income to fund the next property acquisition, and repeat the process.

The BRRRR strategy can be an effective way to build wealth through real estate because it allows you to use leverage to acquire more properties without tying up all of your cash. By refinancing the property after it's been rented out for a period of time, you can take advantage of lower interest rates and better terms, which will help you build equity more quickly and maximize your cash flow.

However, it's important to note that the BRRRR strategy does require some upfront capital, as you'll need to purchase the property and fund the renovations. It's also important to do your due diligence and make sure the property is a good investment before you purchase it. This includes researching the local real estate market, estimating the costs of the renovations, and calculating the potential rental income and expenses.

In conclusion, the BRRRR strategy is a powerful tool for real estate investors who are looking to build wealth through property investments. By following the steps outlined above, you can use leverage to acquire more properties, build equity, and generate cash flow through rental income. The 70% rule is also a critical part of the BRRRR strategy and a valuable tool for real estate investors. By sticking to this rule, investors can ensure that they are buying properties at a price that allows them to make a profit and minimize their risk. If you're considering this strategy, be sure to do your research and work with experienced professionals to ensure your success.